|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

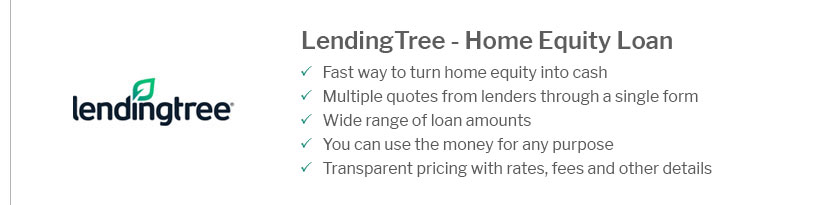

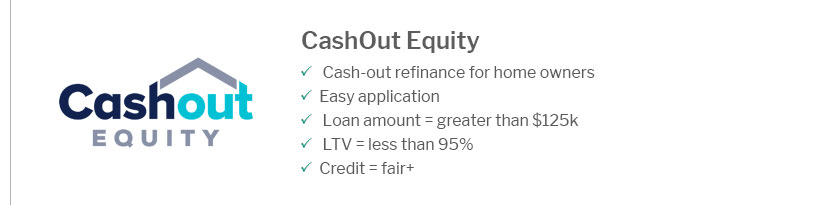

Understanding the Lowest Home Equity Loan Rates for Your Financial BenefitHome equity loans can be a smart financial move when you need access to a significant amount of money. Securing the lowest rates possible is crucial to maximizing the benefits of this financial tool. Let's explore how to find these rates and what factors influence them. Factors Influencing Home Equity Loan RatesSeveral elements determine the rate you might receive on a home equity loan. Understanding these factors can help you navigate the process more effectively. Credit ScoreYour credit score is a major determinant of the loan rate. Lenders prefer borrowers with higher scores as they are considered less risky. Improving your score can lead to better rates. Loan-to-Value RatioThe loan-to-value (LTV) ratio compares the amount of the loan to the value of your home. A lower LTV ratio often results in lower interest rates. Strategies to Secure the Lowest Rates

For first-time buyers, exploring programs such as the first home buyer program nc can provide additional insights and opportunities. Current Market TrendsThe housing market and economic conditions also impact home equity loan rates. Staying informed about these trends can guide your decisions. Economic IndicatorsInterest rates are influenced by economic indicators like inflation and the Federal Reserve's policy changes. Keeping an eye on these can help you anticipate rate movements. For an update on current trends, you might want to check fha interest rates today for a broader understanding of how government-backed loans are behaving. FAQ

By understanding these factors and strategies, you can better position yourself to obtain the lowest home equity loan rates, ultimately saving money and enhancing your financial health. https://www.nerdwallet.com/mortgages/mortgage-rates/home-equity-loans

Specializes in HELOCs. The initial balance and any additional draws have a fixed interest rate. Closing may be available in just five days. HELOCs are available ... https://www.gecreditunion.org/personal/borrow/loans/home-equity

Need one more really good reason to love your home? It can help you qualify for a low-cost loan that can be used for nearly any project, purchase or purpose. https://www.thirdfederal.com/borrowing/home-equity

And because you're borrowing against the value of your home, your interest rate is usually quite low. Home Equity Lines vs. Home Equity Loans. There are two ...

|

|---|